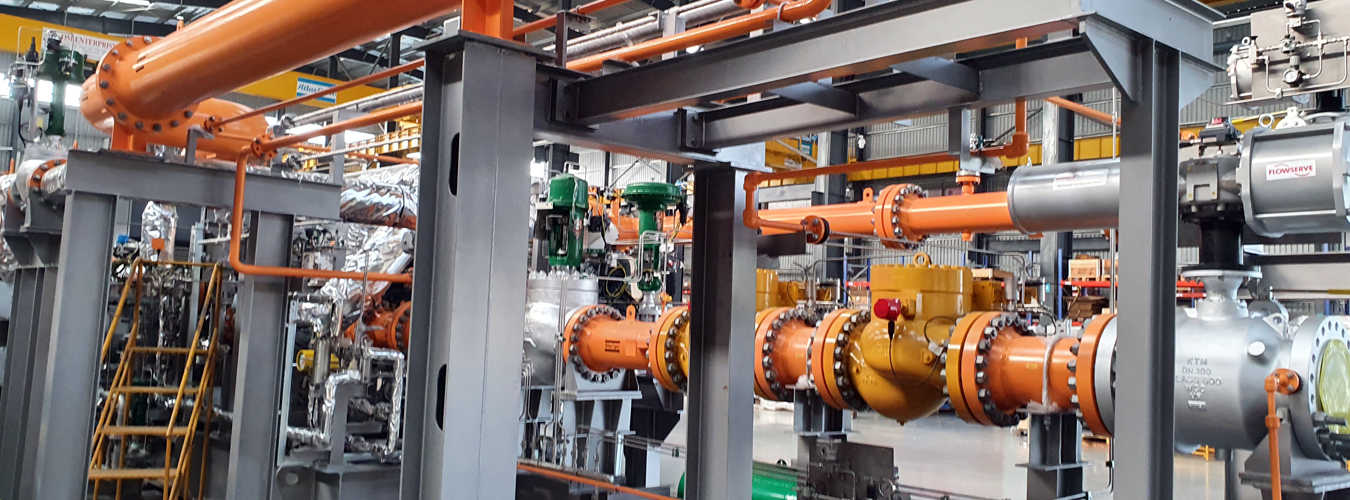

精馏塔管道制造工作,不锈钢(SS)管道制造,碳钢(CS)管道制造,双钢管道制造,流动元件,文丘里管,平均皮托管管,夹套上螺栓,夹套上夹具,蒸馏塔,容器制造工作,压力容器制造工作,反应堆制造工作,夹套容器制造工作,帽管盘管容器制造工作,储罐制造工作,不锈钢容器制造,碳钢容器制造,结构制造工作,热交换器,蒸发器和冷凝器,后冷却器,油冷却器,中间冷却器,特殊用途的热交换器,定制设计的热交换器,液位传感器室,离心机,工业旋转干燥机(重型),纱线染色机,软流织物染色机,制造商,出口商,供应商,制造商,服务,浦那,马哈拉施特拉邦,印度

关于我们?

成立于2010年

“ASME U印章,NBIC R印章,ISO 9001: 2015”认证

我们目前供应的石油和天然气,化工,蒸馏,废水处理和制药行业

主要产品有预制管道,机加工底座,套上螺栓,压力容器,热交换器,加药橇,工艺橇和空气接收器。

提供不锈钢,碳钢,双相钢,英科乃尔,蒙乃尔,哈氏合金,合金钢,钛的制造服务。

我们的客户